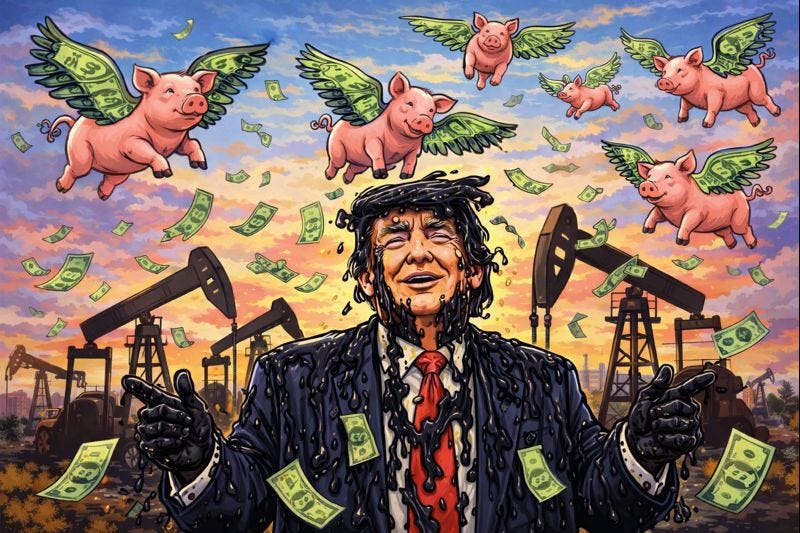

The Nonsense Tax: Trump Oil Edition

A Retail-Politics Surcharge on a Global Commodity System

Oil is not priced by morality, or strength, or vibes.

It is priced by credible future barrels.

When governments turn oil into a stage prop, they don’t just “get it wrong”. They add a risk premium that shows up as higher prices, higher volatility, and lower investment.

The public pays.

The attention-economy operators collect.

This is the Nonsense Tax.

I. The Price Fantasy

The headline claim (from Trump): “$50 oil”

What it is: a price anchor, not a plan.

A consumer-pleasing number with meme efficiency

Implies the President can simply set the price of a globally traded commodity

Compresses a complex system into a single moral promise: I will make it cheap

Nonsense Tax mechanism:

The more a leader talks like a price controller, the more investors treat future supply as uncertain. Uncertainty is priced as risk. Risk raises prices.

“Use Venezuela’s reserves”

What it is: reserves-as-prop.

Reserves are geology.

Price is flow.

Flow requires:

infrastructure

skilled labour

diluent

upgraders

contracts

insurance

shipping

sanctions clarity

multi-year capex

Nonsense Tax mechanism:

When a state treats reserves like a valve, capital concludes: this government doesn’t understand the machine it’s threatening to operate. Capital hesitates. Output doesn’t rise. Prices don’t fall.

II. Capital Walks Away

The killer quote (capital says the quiet part out loud)

“No one wants to go in there when a random f*cking tweet can change the entire foreign policy of the country.”

— U.S. oil executive (via FT)

This is not opinion. It is a pricing signal.

It says:

policy is erratic

contracts are not credible

timelines cannot be trusted

political risk dominates project economics

Nonsense Tax mechanism:

If policy is stochastic, investment is optional.

If investment is optional, supply growth disappears.

If supply growth disappears, prices rise and volatility spikes.

That’s the invoice.

III. The Domestic Boomerang

$50 oil kills U.S. shale

$50 is not “cheap”.

It is supply destruction.

At ~$50:

marginal shale goes negative

rig counts fall

decline rates bite fast

banks tighten credit

production drops

prices rebound harder later

Nonsense Tax mechanism:

Trying to force low prices today guarantees higher prices tomorrow. Consumers get a brief sugar high, then a crash.

You can’t out-theatre OPEC+

If the U.S. somehow adds Venezuelan barrels:

OPEC+ cuts to defend price

exporters defend fiscal break evens

traders front-run the reversal

geopolitics adds premium

Nonsense Tax mechanism:

Your “victory” becomes everyone else’s stabilisation problem. The market prices retaliation and uncertainty, not your press release.

IV. Who Gets Paid?

Political Identity Rent

This is the part most analysis misses.

In the Rent Theory of Political Identity, the key variable is rent extracted from identity, not performance.

The identity product

“I’m the leader who makes energy cheap”

“I’m the movement that punishes enemies”

“I’m the realist who controls chaos”

“I’m the patriot who takes the oil back”

The monetisation channels

outrage subscriptions & donations

influencer content flywheels

fundraising off “sabotage”

scapegoat narratives (“cartels”, “traitors”, “deep state”, “foreigners”)

policy churn as attention fuel

volatility as content

Crucial point:

Failure is not disqualifying. Failure is convertible into loyalty.

That is why these claims persist even when they are mechanically impossible.

V. How the Public Pays (The Actual Tax)

The Nonsense Tax is not one number. It is a bundle.

Cost components

Risk premium

Higher expected volatility → higher prices todayUnderinvestment premium

Erratic policy → delayed capex → tighter future supplyTransition premium

Crush domestic producers → lose buffersInstitutional decay premium

Markets stop believing official statementsOpportunity cost

Diplomacy, regulation, and infrastructure replaced by theatre

Because oil is a foundational input, this propagates into:

food

logistics

heating

manufacturing

inflation expectations

interest rates

You don’t just pay at the pump. You pay everywhere.

VI. The Numbers (No Vibes Allowed)

Known inputs

1 barrel = 42 gallons

$1/bbl ≈ 2.4¢/gallon (rule of thumb)

U.S. gasoline use: 376M gallons/day

U.S. petroleum use: 7.39B barrels/year

U.S. households: 134.79M

Historical geopolitical risk premiums: ~$10/bbl (Goldman example)

Assumption

Policy chaos adds a sustained $5–$20/bbl credibility premium.

Pump-price channel (gasoline only)

Using the rule of thumb $1/bbl ≈ 2.4¢/gallon, and current U.S. gasoline consumption:

$5 per barrel risk premium

≈ +12¢ per gallon

≈ $16.5 billion per year in extra gasoline costs

≈ $122 per household per year (averaged)

$10 per barrel risk premium

≈ +24¢ per gallon

≈ $32.9 billion per year

≈ $244 per household per year

$20 per barrel risk premium

≈ +48¢ per gallon

≈ $65.9 billion per year

≈ $489 per household per year

Whole-economy petroleum channel

(everything that runs on oil)

Using total U.S. petroleum consumption (~7.39 billion barrels per year):

$5 per barrel risk premium

≈ $36.95 billion per year

≈ $274 per household per year

$10 per barrel risk premium

≈ $73.9 billion per year

≈ $548 per household per year

$20 per barrel risk premium

≈ $147.8 billion per year

≈ $1,097 per household per year

This is not just gasoline.

It’s trucking, food logistics, plastics, heating oil, jet fuel — everything.

VII. The Skim: Political Identity Rent

Let r be the take-rate captured by the attention ecosystem.

Identity Rent = r × Nonsense Tax

Using the $10/bbl case (~$73.9B/year):

0.1% → $73.9M/year

0.5% → $369.5M/year

1.0% → $739.0M/year

You only need a tiny take-rate to build a massive political-media business.

Failure doesn’t kill the product.

Failure is the product.

VIII. Is This “Rational”?

Rational for consumers / macro stability ❌

No. Chaos raises prices.

Rational for retail-politics rent extraction ✅

Yes.

Because the payoff isn’t the price level —

it’s what the price level lets you do.

Trump is optimising for control, narrative, and rent.

Oil prices are collateral.

IX. How to Falsify This New Model

If the true objective were lower prices, you’d expect:

boring, predictable policy

stable sanctions regimes

credible multi-year contracts

reduced rhetoric shocks

If the true objective is identity rent, you’d expect:

headline-grabbing moves

constant blame targets

policy reversals

fundraising spikes around each shock

Watch behaviour, not claims.

The Punchline

This is what economic insanity looks like in a commodity system:

Turn oil into theatre

Break policy credibility

Scare away capital

Trigger volatility

Blame enemies

Monetise the blame

Repeat

Oil is a medium.

Identity rent is the business model.