How Disinformation Eats the Economy

A Model of Conspiracy Drag

One of the hardest parts of describing today’s U.S. economy is admitting that it isn’t just “hard data” driving outcomes. Policy, politics, and yes—conspiracy narratives—are shaping jobs, inflation, and innovation.

So let’s put numbers on it.

📊 The Baseline Model

I’ve been tracking U.S. employment, inflation, and fiscal shocks through 2025:

Jobs: After small gains earlier in the year, the labor market tipped negative in August (–3,000 jobs) and September (–32,000 jobs).

Unemployment: Now at 4.2%, creeping upward.

Inflation: Tariffs are pushing costs higher, with CPI likely drifting back toward 3.5–4.0%.

Shutdown shock: The October government shutdown adds further risk—hundreds of thousands furloughed, contracts frozen, demand knocked down.

This paints a fragile picture: weak job creation, sticky inflation, and little fiscal room left.

🧩 Adding the “Conspiracy Factor”

But there’s more. Disinformation—whether anti-vaccine, anti-farming, anti-science, or anti-institutional—creates measurable economic harm.

I built a Conspiracy Policy Uncertainty Index (C-PUI) with four components:

Misinformation Volume (narratives circulating online).

Policy Distortion Events (FDA disruption, blocked mandates, defunded R&D).

Adoption Lags (delays in vaccine uptake, GMO use, 5G rollout).

Fiscal Fallout (bailouts, lawsuits, subsidies caused by politicized pressure).

Each point on this 0–10 scale translates into:

+0.05% unemployment,

+0.05 percentage points of inflation,

+a few billion dollars in fiscal costs.

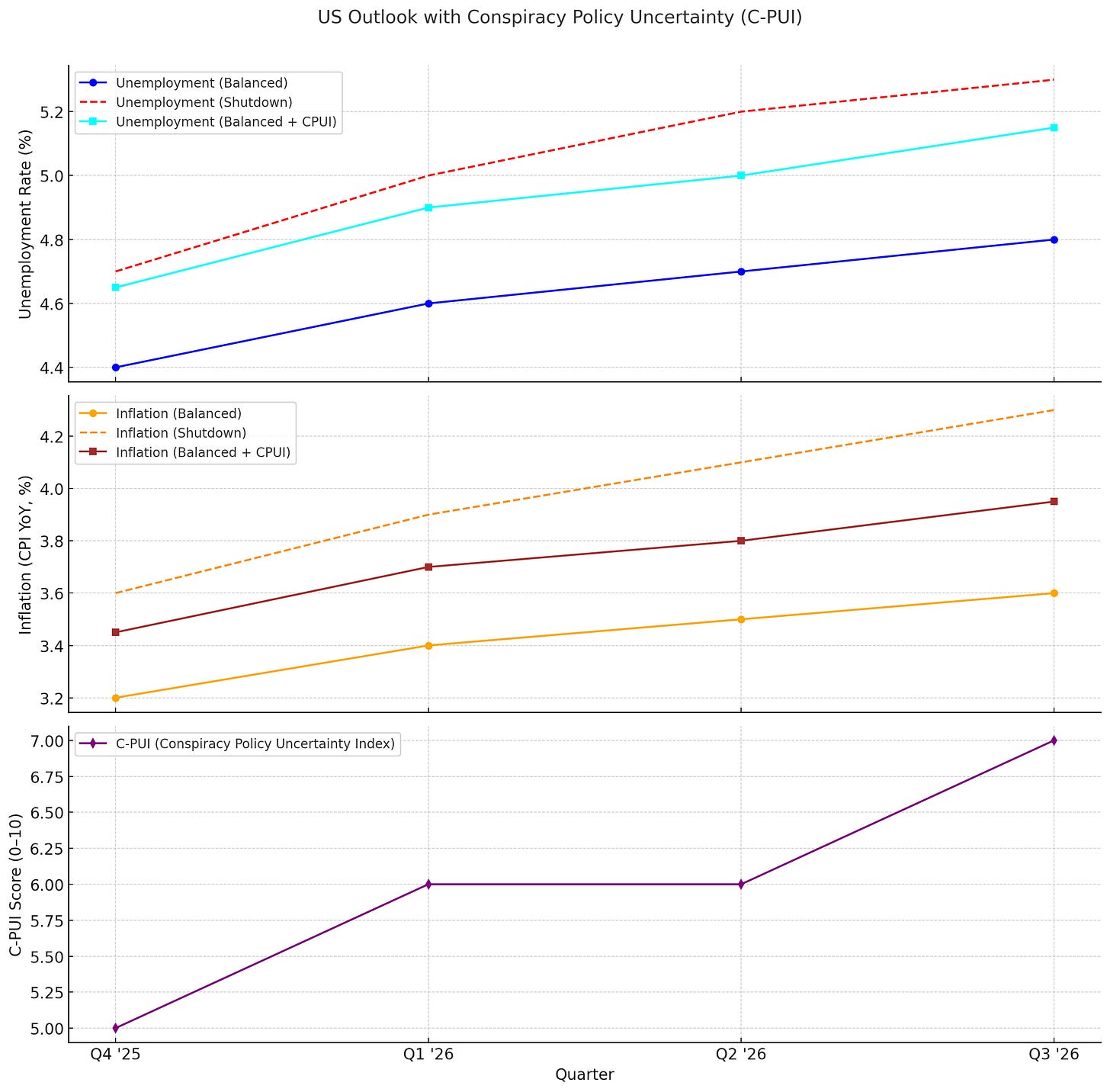

📈 What the Charts Show

In my projections:

Balanced economy (no disruption): Unemployment edges to ~4.8% by late 2026; inflation eases to ~3.5%.

With C-PUI drag (score ~6–7): Unemployment breaches 5%, inflation sticks nearer 4%.

Shutdown scenario: Both worsen: 5.4% unemployment, 4.3–4.5% inflation by mid-2026.

That difference—the gap between the balanced line and the CPUI line—is the economic cost of disinformation.

💸 Monetary Harm in Practice

Farm bailouts: Tariff retaliation hurts exports, so rural senators demand subsidies. That’s inflationary fiscal easing.

Vaccine disruption: Delays in uptake = longer pandemics, higher healthcare costs, lost productivity.

Innovation flight: Moderna shifting production to the UK is a direct response to U.S. FDA turmoil. Once labs leave, they rarely come back.

Disinformation isn’t just cultural noise. It distorts policy, triggers costly subsidies, and pushes innovation offshore.

⚠️ The Stagflation Risk

The 1970s taught us: mix supply shocks with political denial, add fiscal giveaways, and you get stagflation—rising prices alongside falling jobs.

Today’s conspiracy-fueled policy distortions act as exactly that kind of accelerant. If tariffs and bailouts collide with institutional weakness, the U.S. risks a replay.

🧠 Final Thought

We’ve always known disinformation corrodes trust. Now we can see it corrodes balance sheets too.

Every time a policymaker caves to conspiracy-driven pressure, the economy pays. The cost is measurable: tens of thousands of jobs, percentage points of inflation, billions in lost R&D.

Disinformation doesn’t just rot democracy—it drags GDP.

So important to put numbers on disinformation because the mighty dollar is all some people care about.

If I may nerd out to this... I want to put a Clausewitz lens on this.

Why? Carl von Clausewitz was a Prussian military thinker whose 1832 book On War defined modern strategy; he matters here because he saw war as a clash of wills shaped by emotion, chance, and reason. And I've kind of superimposed that framework onto society and the problem of information warfare.

Through a Clausewitz lens, this is war by other means: the trinity of government (policy caving to narrative pressure), military (defence innovation stalled by anti-science drag), and people (mass belief weaponized into economic self-sabotage) becomes a vulnerability caused by disinfo. How? Well, disinfo exploits the friction between them, turning public paranoia into a force multiplier for domestic decay. A lie is cheaper than any missile, deadlier to resilience. Your model gets it.

I kind of, only kind of, wrote about in this article (yes I know its a shameless plug)

https://substack.com/home/post/p-177342628